With 2021 coming to an end, it is time to reflect on the performance of investments throughout the year. This past year has had times of very high volatility in the cryptocurrency market and the stock market. The fast-moving markets highlight the importance of stable returns in a portfolio. We have seen a shift from traditional investments into more alternative investments throughout this past year. Alternative investments are defined as any asset class other than stocks, bonds, and cash.

After the volatile 2020, investors looked forward to a recovering economy in 2021 with the distribution of vaccines and the easing of lockdowns. Last year faced challenges of new variants, labor shortages, supply chain issues, and rising inflation, which all affected investments and inflation. Inflation rose to 7%, the most significant increase in nearly 40 years.

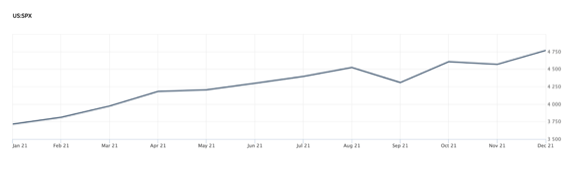

For traditional investments, we will consider stocks and bonds. The stock market had a primarily solid year besides a few significant selloffs. The S&P 500, which is a good indication of the overall stock market, had a 28.47% return for the year. The high returns are abnormal compared to high inflation experienced throughout the year. Since inflation eats away at a company’s profitability, the stock price will normally go down. However, when money is as cheap as it is today because of the fed overnight rates, stock prices rose. The question then is, “what will happen when the fed moves the overnight rate higher?” When looking at bonds, we will use a bond index to evaluate performance. The S&P U.S Government and Corporate Bond Index tracks the performance of debt issued in U.S. markets, like the U.S. Treasury and investment-grade corporate securities. This index had a -1.62% return in 2021. In January of 2022, the central bank plans to accelerate the reduction of its monthly bond purchases. The Fed will start to raise interest rates after this process is done and that is when things will start to get interesting.

S&P 500 2021 Chart:

Per: https://www.wsj.com/market-data/quotes/index/SPX/advanced-chart

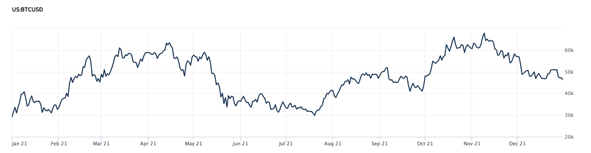

For alternative investments, we will consider cryptocurrency, real estate investments, and Family Business Fund (FBF). Since Bitcoin is the most popular cryptocurrency, we will look at the returns from 2021. Bitcoin started the year around $32,000 and ended at around $47,000, making close to a 50% return. But with extraordinarily high returns comes similarly high volatility. Looking at real estate, the market has seen a considerable increase this past year, with REIT returns mainly ranging from 25%-35%. Family Business Fund paid 20% annually until the end of October, when the yield was reduced to 15%.

Bitcoin 2021 Price Chart:

Per: https://www.wsj.com/market-data/quotes/fx/BTCUSD/advanced-chart

While many other investments had a solid year, Family Business Fund offers more consistent returns. FBF has yielded stability by paying a fixed rate of 15%, which is a feature that many other investments simply cannot offer. FBF can produce significant returns with its high-yield, fixed-income investments while also assisting a portfolio with flattening volatility.