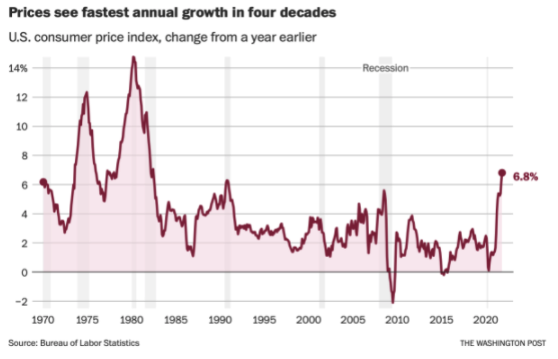

Rising inflation throughout 2021 will likely cause the Fed to implement policies much faster than expected. The annual inflation rate in the US has increased to 6.8% in November 2021. The main contributors to the rise are gasoline, housing, food, and transportation. Inflation has been showing its effect on the Dollar General store, whose goal is to sell items for $1 or under is increasing their prices to $1.25 and $1.50 for specific products. The main factors that cause this price increase are the rising cost of labor, raw materials, and supply chain expenses. As well as solid demand for goods from the coronavirus variant being announced and a high money supply stimulating spending.

Source: https://www.washingtonpost.com/business/2021/12/10/inflation-november-cpi-fed-biden/

The Federal Reserve System (or the Fed) is the central banking system of the United States. One of the Federal Reserve’s primary responsibilities is to conduct the nation’s monetary policy by influencing money supply and credit conditions in the economy for employment and stable prices. The type of policies used either expand or contract the economy. The chair of the Federal Reserve is led by Jerome Powell, who is responsible for carrying out mandates of the Fed.

Jerome Powell expects policymakers to accelerate the schedule for the tapering of monthly bond purchases. Tapering would be a reversal of quantitative easing, which is used to stimulate economic growth by central banks purchasing a pre-established amount of government bonds or other financial assets to insert money into the economy. Tapering is the first process of loosening up from a monetary stimulus program. When the pandemic struck in 2020, the Fed started buying trillions of dollars to bonds and eventually slowed the pace to $120 billion per month in June 2020. The purchasing amount has been cut down in November 2021 to 15 billion worth of bonds a month, consisting of $10 billion in treasuries and $5 billion in mortgage-backed securities.

The initial tapering schedule would have bond purchases ending in June 2022. If the purchasing is quickened following the Fed December meeting, buying of the bonds would end in spring and allow the Fed to raise interest rates any time after. A higher interest rate results in higher borrowing costs; businesses and consumers will cut down on spending. Consumers tend to save during high-interest rates because their savings returns are higher. With less disposable income being used, the economy slows down, and inflation decreases. On the other hand, low-interest rates allow people to borrow more money. This result will enable consumers to have more money to spend to increase the economy and for inflation to rise.

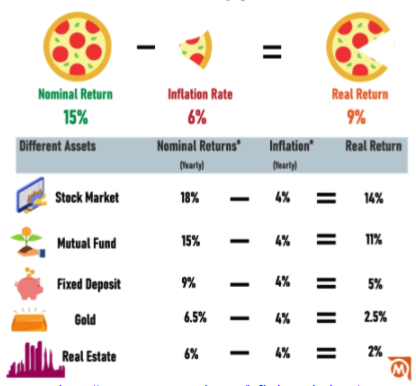

With rising inflation, it is essential to protect the purchasing power of money. A high inflation rate could be covered with a high yield investment such as the Family Business Fund. The Family Business Fund offers a 15% annualized return on investment, bringing an inflation-adjusted return of 8.2% with the current inflation rate of 6.8%. Removing the effects of inflation allows investors to see their true earning potential. The Family Business Fund has recently partnered with NuView Trust allowing investors to get into alternatives easily. Investors can now have the opportunity to work with their financial advisors and add the Family Business Fund high-yield fixed-income investment to their portfolio.

Source: https://www.moneycontain.com/inflation-calculator/