Dear Loyal Investors,

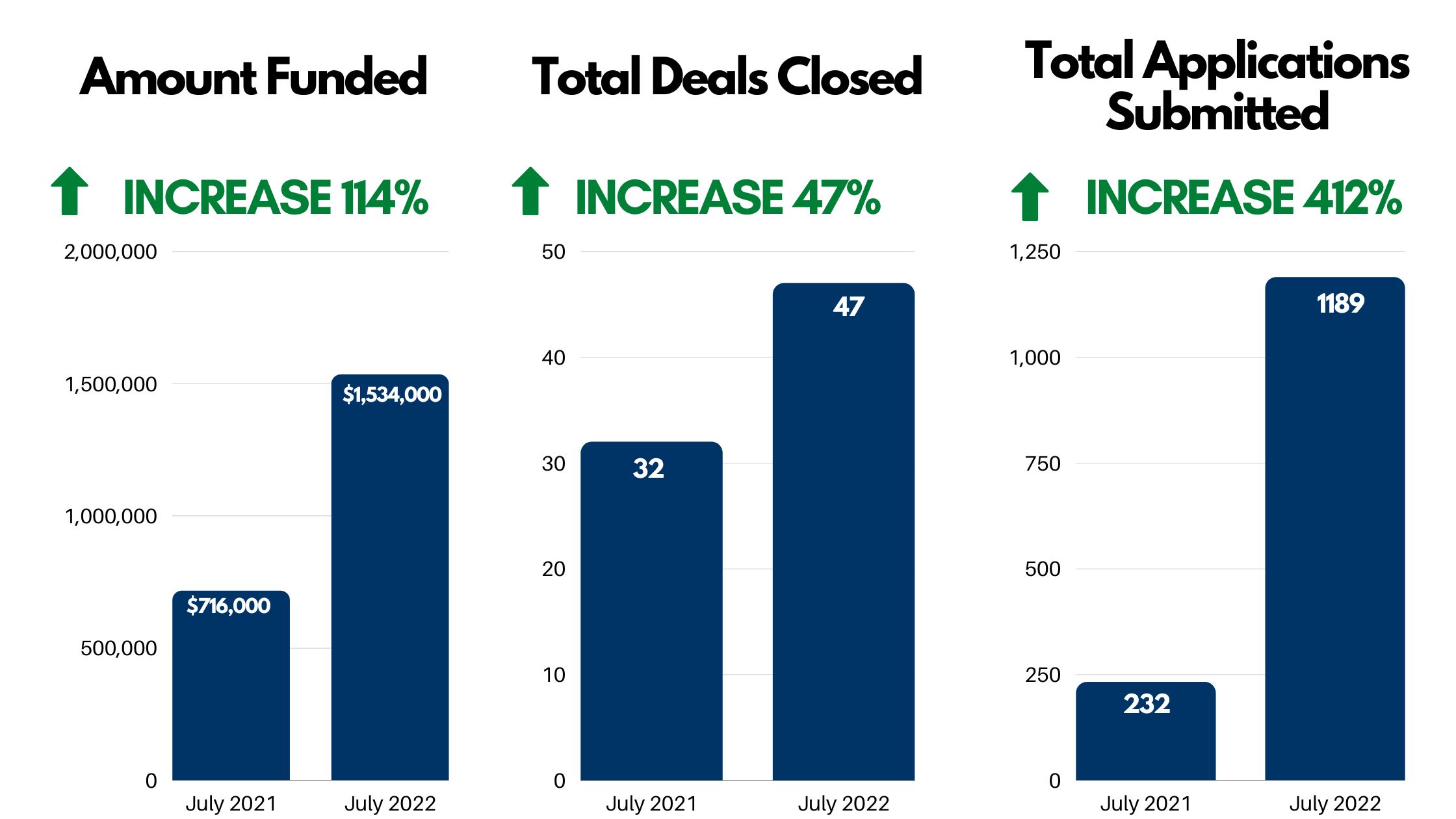

While other groups may use July as an opportunity to catch their breath or enjoy some time off, your team at FBF remained hard at work. Doug, Rob and Ryan spent a week in New York City meeting with strategic investors and some of the most important groups in our business broker network. Not only did we solidify our relationships with our brokers, but we also secured a term sheet for $9 million from a new investor group. We are not prepared to release specifics yet and are under strict non-disclosure requirements while due diligence is being performed, but we are excited to see that the private equity community has finally discovered what we have known all along: traditional banking does not work for many small-medium sized businesses and traditional investing is dead. (Someone should come up with a podcast or newsletter with that title.) We will not wait until the end of the month to send you an update if we close our $9 million investment, but let’s not engage in premature celebration yet. There’s still much that needs to be done. Our July 2022 numbers are below. We have engaged a new firm in south Florida to help us with our collections/reconciliation efforts. We are excited about the new technology and innovation that they will bring to the process. We remain vigilant about defaults but remind you that the FBF Manager covers any and all defaults in our MCA portfolio, so you, as an investor, are never impacted by a defaulting merchant.

With appreciation,

Douglas Muir, CEO

Updates:

Latest Podcast Episode:

.jpg) |

Traditional Investing Is Dead Episodes Are Now Available Wherever You Get Your Podcasts!

|

Articles:

.png) |

|

| How can Alternative Investments Beat the Negatives of Inflation?

July 25, 2022 |

|

|

|