Dear Loyal Investors:

May was certainly a busy month for the staff of FBF as we spent countless hours reconciling our financial records with our certified public accounting firm. For those of you who do not know, we use QuickBooks for our internal accounting record-keeping. We ran into a problem when we tried to migrate our accounting to a firm in Florida. Dozens of deleted accounts later, we were left wondering what had happened. We went back to our old CPA firm in Charlottesville and had to re-input all of our MCA contracts, income and expenses one item at a time for 2021 and 2022. The bulk of this painstaking work fell on Valeria Bisenti and Will Carico. They worked late nights, early mornings and every weekend for the entire month and deserve much credit for what they were able to do in rebuilding our financial records. After our CPA firm reviewed our QuickBooks, they prepared our financial statements and restated our 2021 and 2022 numbers using an accrual accounting method instead of a cash basis so that our financial statements can be certified in accordance with GAAP (Generally Accepted Accounting Principles). Apparently, the switch from cash basis to accrual basis is not kind for an MCA company.

For those of you who do not know, GAAP-certified accrual accounting requires a company to realize income over the life of an underlying MCA contract and not from the first few payments. Because our management company fully guarantees any default in our portfolio, we used a cash basis accounting method when recognizing income for our management company (FBFM), but private equity and other institutional investors require an accrual basis. In our minds, this is a simple case of moving funds from one pocket to another, but outside partners who see our restated financial statements for the very first time will misinterpret and misunderstand the liability that appears on the books from FBFM to FBF. At a minimum, it would require an explanation on our part. Rather than attempt to unwind the past, our accountants recommended the following action items to reduce the perceived liability: (1) keep writing contracts, (2) reduce costs and (3) take the absolute minimum in management fees for the next several quarters. We also have some other ideas that we are exploring that involve adding additional revenue streams. To that end, we created a new budget for the remainder of the year and are intent on reducing the liability as soon as possible. The good news is that all of our books are balanced, and all bank statements, advances and payments have been reconciled. Also, our year-to-date 2023 numbers using the accrual method are good.

As I mentioned earlier, the accounting change will not impact any of our economics or affect our investor accounts, but it will certainly slow our charge down the BDC path. Rob and I spent time in New York with our colleagues from A3 meeting with investors and advisors for the BDC and we are evaluating our next steps. We are being reassured that BDC investors are not interested in the FBF promissory note but in the risk-return profile of a registered, regulated MCA portfolio. We will keep you updated on the BDC status.

Before I share with you our numbers from last month, I wanted to remind you that all investor inquiries should be sent directly to Rob Masri. Please try not to email me or Valeria with any questions or requests related to investor matters. Please also note that we will not accept account changes via email anymore. If you would like to change your payment account details, you must call Rob directly. We had an incident last month where one of our investors had their email hacked. The impostor contacted us via email and asked us to change the details for the investor’s monthly interest payment to a different account. The impostor failed to respond to certain email requests from our staff and finally, our investor logged in and saw an email communication from us regarding the account change. The investor immediately called us, and we were able to avoid a very messy situation. Accordingly, contact Rob directly at rob@familybusinessfund.com with general questions but call him at 703-963-7576 with any financial updates to your account.

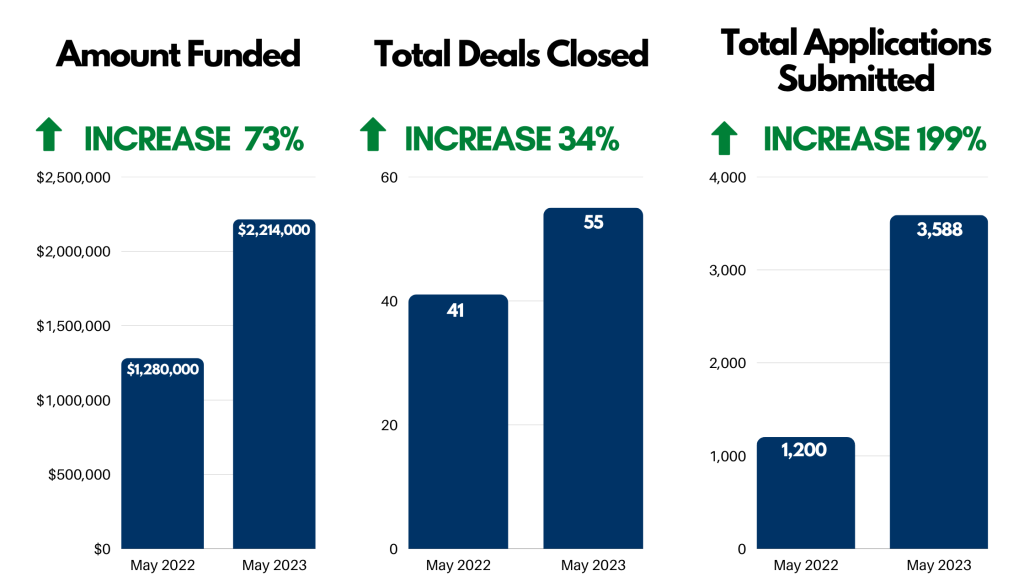

Below are last month’s numbers. Our 12-month average default rate continues to hover at around [13%].

As always, we thank you for your confidence and trust.

Sincerely,

Douglas Muir

Latest Article:

What is the Difference Between the PCE & CPI?

Latest Podcast:

GDP Update: May 3rd, 2023