Protecting Against Inflation With Alternative Investments

There remains a great deal of uncertainty in the world of investments due to inflation continuing to rise and the war between Ukraine and Russia. A good indication of the behavior for the stock market as a whole is the S&P 500 index, which is down around 10% in the first two months of 2022. A popular way to measure the volatility in the equity market is the CBOE Volatility Index (VIX), which signals the level of fear and/or stress that is present in the current market. A high VIX price (usually levels above $30.00) indicates a mass of fear. The price as of February 22nd, 2022 is $29.47. With this frightening equity market signal, investors seeking more safety are looking towards the bond market. Consider a 30-year treasury bond. While bonds may provide safety during these unpredictable times, the yield is only around 2.25%. With the current rate of inflation at 7.5%, investors are losing 5% a year with these bonds. Investors are being forced to make the decision between accepting high volatility for high (yet unpredictable) returns or sitting with the safety of fixed income options whose yields have trouble keeping up with inflation. If geopolitical tensions and macroeconomic inflation continue to rise, investors will increasingly seek a better, more reliable investment option.

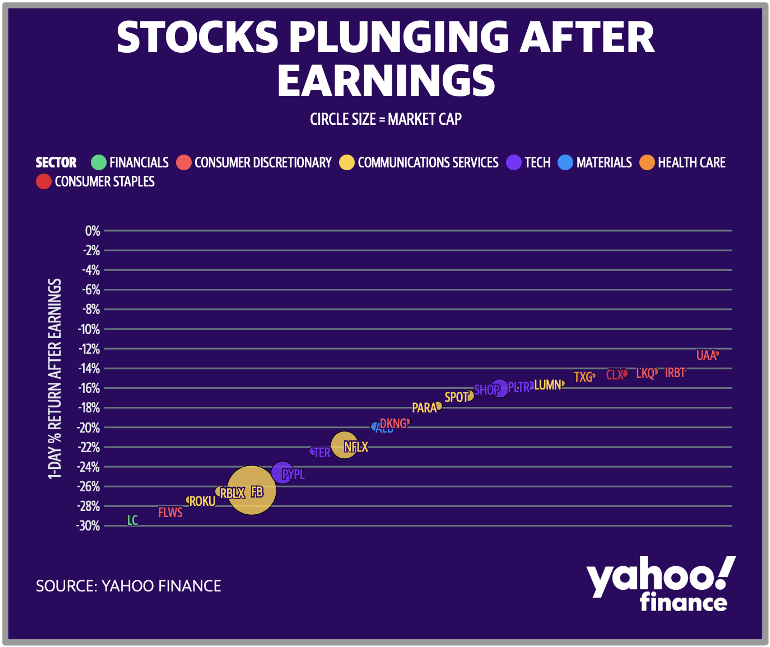

Per: https://finance.yahoo.com/news/why-stocks-are-plummeting-this-earnings-season-135041555.html

Per: https://finance.yahoo.com/news/why-stocks-are-plummeting-this-earnings-season-135041555.html

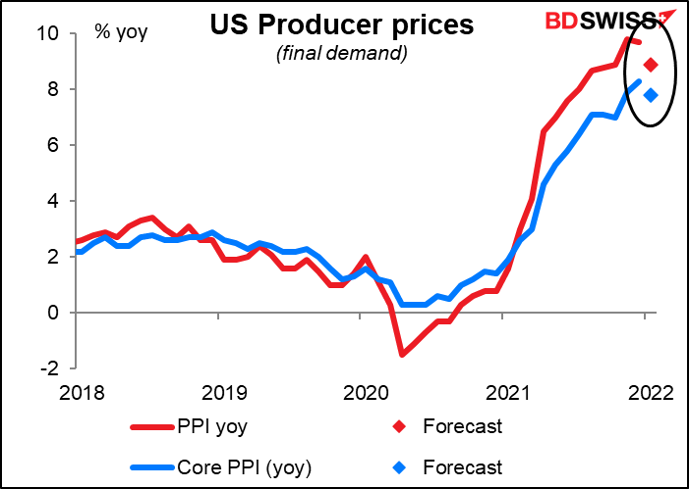

Inflation, by definition, is the decrease in the purchasing power of money from the increase of goods and services in an economy. Recently, the U.S. has seen some of its highest inflation rates due to supply chain disruptions and an increased money supply. The growth rate of all U.S. dollars in circulation increased by a historic 27% in 2020-2021, which is the biggest jump ever in money supply throughout U.S. history. To gauge current inflation, we can also look at the Consumer Price Index (CPI), which measures inflation by tracking the changes in prices paid by consumers over time. The January 2022 CPI report stated that the annual inflation rate rose to 7.5%. Yet another economic indicator to measure inflation is the Producer Price Index (PPI), which measures the average change in sale prices for the market of raw goods and services. In January of 2022, the PPI rose to an annual pace of 9.7%.

Per: https://www.fxstreet.com/analysis/up-up-and-away-202202111451

Through the analysis of the current inflation conditions, investors frequently ask, “How do I protect my investments from this?”. There are many ways to defend your invested money from this rising inflation, such as commodities, cryptocurrency, gold, etc. When an investor wants to hedge against inflation with minuscule amounts of risk, short-term bonds are usually a popular option. Short-term bonds can provide a steady, predictable, safe source of income. If rising inflation leads to higher interest rates, short-term bonds will not be exposed to the interest rate risk that long-term bonds will be. Investors can also reinvest in short-term bonds at higher interest rates as their current bonds mature. Ultimately, a fixed, short-term bond will help to combat inflation and comfort investors during uncertain times.

While short-term bonds are a popular and safe option, the returns are nothing special. Many investors are wondering where to put their money to generate a greater, more significant return. The answer to this, for some, lies in the world of alternative investments. Historically, alternative investments have a low correlation to more traditional asset classes. This aspect alone reduces overall risk and provides an opportunity for portfolio diversification. Luckily, there is an investment opportunity that may fit this feature perfectly while also protecting against macroeconomic uncertainty and moderate inflation. The Family Business Fund offers an alternative investment option, which is a short-term note that has an annual fixed rate of 15%. The lock-up period is only 18 months, and the investment pays returns monthly. Investors in the Family Business Fund benefit from a reliable income stream with a high yield. The 15% returns during these current times of unpredictably high inflation would allow for a real return of 7.5%. This, in turn, could allow investors to maintain the purchasing power of money while still gaining a return on invested capital.