The Consumer Price Index (CPI) just came out and once again inflation is on the rise (CPI 7.9%). That means cost for products and services we purchase are 7.9% higher this month. I don’t know about you, but my paycheck did NOT go up 7.9%.

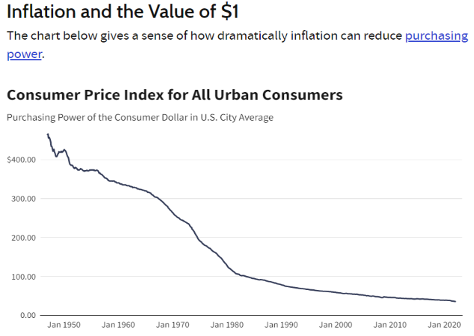

Investors, the Federal Reserve, and businesses continuously monitor and worry about the level of inflation. What is Inflation? It’s the rise in the price of goods and services resulting in reduced purchasing power of each unit of currency. Rising inflation can be harmful: costs for companies to produce a product (input prices) are higher, consumers lose purchasing power unless their incomes rise, and monetary policy (Federal Reserve) actions to contain inflation can damage growth and employment.

While some companies can react to inflation by raising their prices, others who compete in a global market may find it difficult to stay competitive with foreign producers that don’t have to raise prices due to inflation.

More importantly, inflation robs investors (and everyone else) by raising prices with no corresponding increase in value. You pay more for less. A company’s financials are overstated by inflation, because the numbers (revenue and earnings) rise with the rate of inflation, in addition to any added value generated by the company.

Source: St. Louis Federal Reserve Add this chart to your site

So where are investors placing their bets? There are a few hedges against inflation. Stock traders purchase value stocks (a stock trading at levels that are perceived to be below its fundamentals) or growth stocks (stocks of companies expected to grow sales and earnings at a faster rate than the market average). But one must consider that the volatility (VIX) of the stock market increases as inflation increases. Gold, Bitcoin, treasury bonds specifically (Series I Savings Bonds) normally do well in a volatile market. The one investment I love are those alternative investments your financial advisor will never tell you about. These are high-yield fixed-income investments that pay rates from 8% to 20% no matter what the geopolitical or stock markets are doing.

Family Business Fund (FBF):

Family Business Fund offers an SEC Reg. D 506 C, high-yield, fixed income investment opportunity that pays 15% annually with monthly distributions. This high interest rate helps to fight off inflation that could take away from an investors’ returns. FBF allows investors to take advantage of fixed payments that bring stable cash flows without the volatility that other investments have.