Two crucial economic indicators that provide insights into the health of the economy and its impact on consumers and businesses are the Personal Consumption Expenditures (PCE) report and the Consumer Price Index (CPI) report. While both reports provide information on inflation, they have different methodologies and focus areas. Understanding the differences between these reports is essential for evaluating the economy’s performance and its implications for consumers and small businesses.

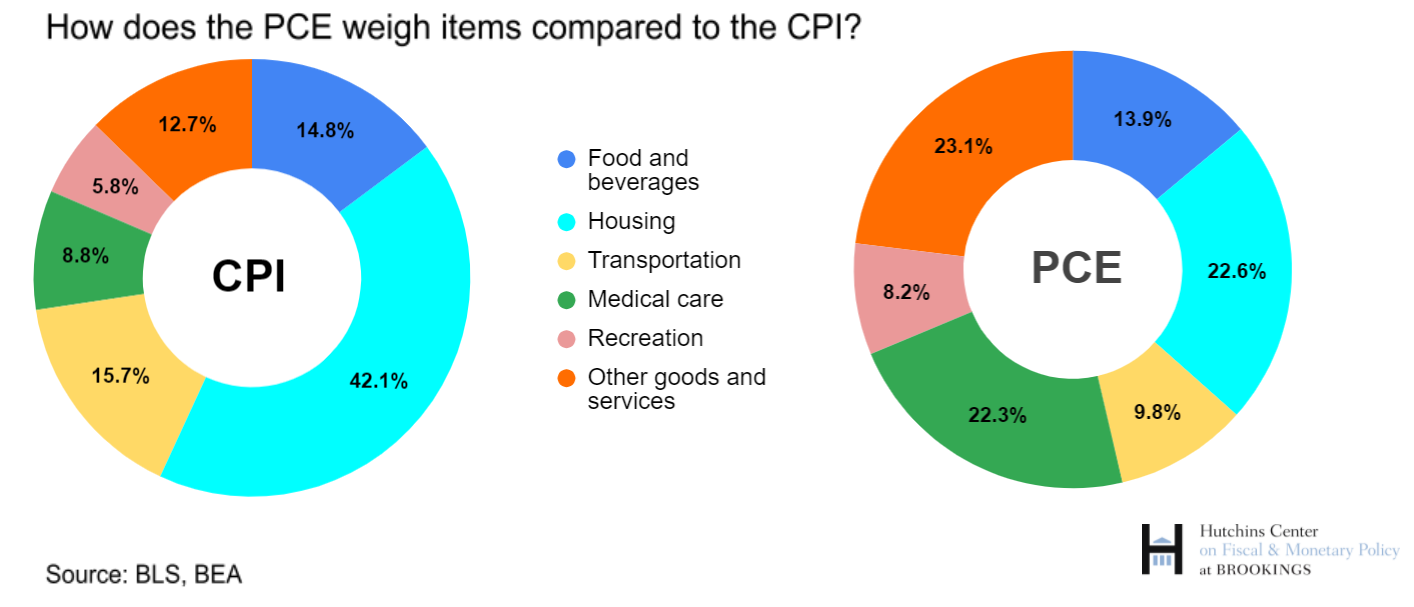

The PCE and CPI differ in terms of the goods and services they measure, their systems, and the index they use. The PCE primarily considers personal consumption expenditures, which includes goods and services consumed by individuals, businesses, and the government. In contrast, the CPI report focuses on the prices of a fixed basket of goods and services typically bought by urban consumers.

Two examples highlighting the differences in what is covered under the (PCE) report and the (CPI) report:

Housing

The PCE report includes a broader range of housing expenses compared to the CPI report. In the PCE report, housing expenses encompass not only rent and mortgage payments but also property taxes, homeowners’ insurance, and utility costs. It provides a more comprehensive view of the overall cost of housing for individuals, businesses, and the government. In contrast, the CPI report focuses mainly on rent and homeowners’ equivalent rent, providing a narrower perspective on housing costs.

Healthcare

The PCE report covers a wider range of healthcare expenditures compared to the CPI report. It includes not only the prices of medical services and prescription drugs but also health insurance premiums and medical supplies. This comprehensive coverage reflects the broader scope of healthcare costs. In contrast, the CPI report focuses primarily on the prices of medical services and prescription drugs, providing a narrower view of healthcare-related expenses.

As of the most recent reports, the PCE report indicated an inflation rate of 2.3%, while the CPI report showed a slightly higher inflation rate of 2.6%. It is important to note that these figures are subject to change and can vary depending on the specific period and region being analyzed.

In terms of the average numbers, the Federal Reserve has historically targeted an average inflation rate of around 2%. Therefore, the current figures for both reports are slightly higher than the average. This may suggest a moderate increase in overall prices, which could impact consumers and small businesses.

The PCE report and CPI report have direct implications for consumers and small businesses. When inflation rates rise, consumers experience a decrease in purchasing power, as their income may not keep pace with rising prices. This can affect their ability to afford essential goods and services, impacting their overall standard of living.

For small businesses, inflation can present challenges in various ways. Increased costs for raw materials, energy, and labor can squeeze profit margins. Small businesses may find it difficult to pass on these increased costs to consumers, resulting in reduced profitability or potential business closures. Moreover, inflation can also affect consumer demand, as individuals may cut back on non-essential spending due to rising prices.

In conclusion, while both the PCE report and CPI report provide insights into inflation, they differ in their focus areas, methodologies, and index calculations. The current numbers for both reports are slightly above the historical average, indicating a moderate increase in prices. These inflationary pressures can impact consumers by reducing purchasing power and small businesses by squeezing profit margins and affecting consumer demand. Monitoring and understanding these reports can be very important for assessing economic conditions and making informed decisions for both consumers and small businesses.