Small business owners face numerous challenges in today’s dynamic economic landscape. One crucial aspect that is often overlooked is monitoring the Consumer Price Index (CPI) report. The CPI is a key economic indicator that measures changes in the prices of goods and services over time. This article will explore three reasons that small business owners should prioritize monitoring the CPI report.

- Pricing Strategies and Profitability:

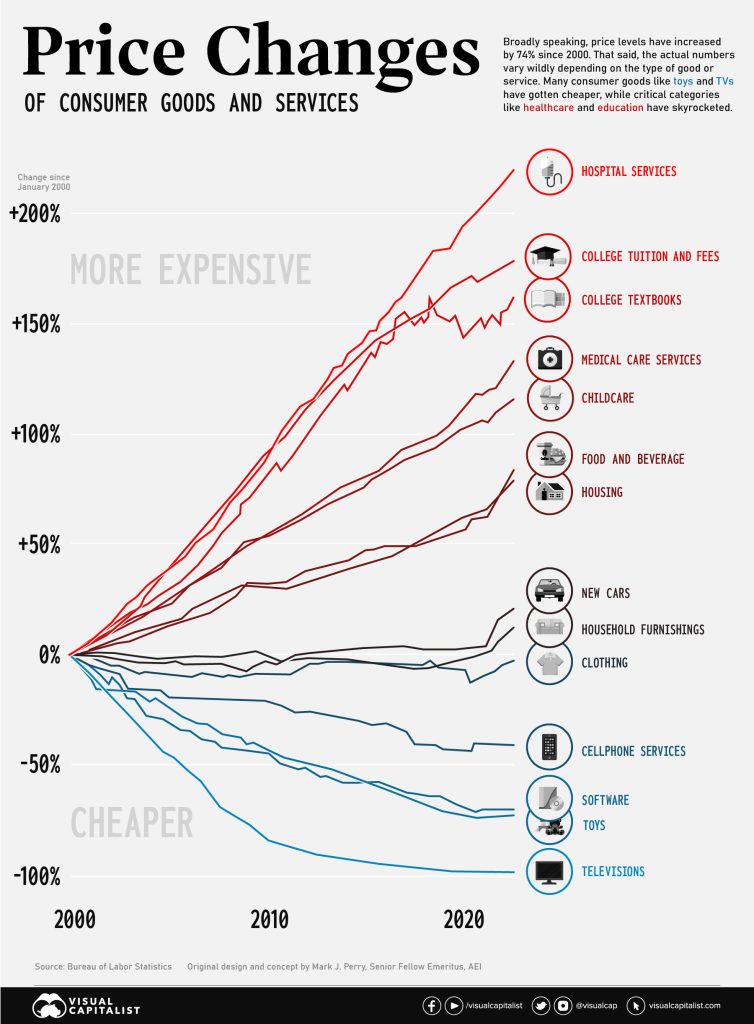

The CPI report provides valuable insights into the overall inflationary trends in the economy. Small business owners need to understand how changes in consumer prices can impact their pricing strategies and overall profitability. By tracking the CPI report, they can gauge whether prices are rising or remaining stable across different sectors and adjust their pricing strategies accordingly. This information enables them to maintain competitive pricing, protect profit margins, and ensure the financial sustainability of their businesses.

- Cost Management and Forecasting:

Inflation affects the costs of inputs such as raw materials, labor, and utilities, which can significantly impact small businesses’ cost structures. By monitoring the CPI report, small business owners can anticipate and plan for potential cost increases in their supply chain. This knowledge empowers them to negotiate better deals with suppliers, seek alternative sourcing options, or implement cost-saving measures ahead of time. Effective cost management based on CPI insights can contribute to improved financial stability and resilience for small businesses.

- Consumer Behavior and Market Trends:

The CPI report reflects changes in consumer prices, which, in turn, influence consumer behavior and market trends. Small business owners need to be aware of shifts in consumer purchasing power and spending habits. By monitoring the CPI report, they can gain insights into how inflation impacts consumer behavior, including changes in preferences, demand patterns, and affordability. This knowledge enables small businesses to adapt their product offerings, marketing strategies, and sales tactics to align with changing consumer needs, stay competitive, and seize new opportunities in the market.

Monitoring the CPI report is crucial for small business owners to make informed decisions about pricing, cost management, and adapting to changing consumer behavior. By keeping a close eye on inflationary trends, small businesses can align their strategies with market conditions, maintain profitability, and successfully navigate economic fluctuations. Regularly monitoring the CPI report allows small business owners to stay proactive, make data-driven choices, and position their businesses for long-term growth and success.

Note: Small business owners should refer to official sources and consult with financial professionals for the most accurate and up-to-date CPI data and personalized advice.