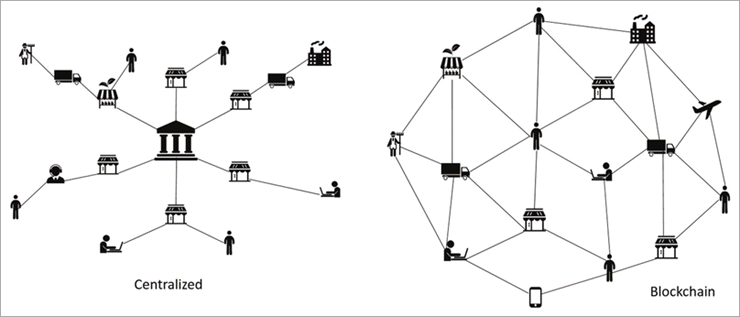

Bitcoin is a decentralized digital currency that uses peer-to-peer technology to operate without the need of a central bank. Bitcoin uses blockchain, which is essentially a network of computers that manages and records the transactions instead of a central hub. Being the first cryptocurrency, Bitcoin is the most valuable and commonly held by investors. It is widely viewed as a “digital gold” since it has many of the same attributes as gold besides tangibility. Also, like gold, it is considered to be a good hedge against inflation. Bitcoin investors believe the currency will gain value over fiat currencies since the supply is fixed at 21 million coins. This coin also has perks of scalability and can be divided into very small amounts. In addition, Bitcoin is portable and can move freely between geographical borders easily. As appealing as Bitcoin sounds, it is important to look at its history and compare it with other investments.

Per: https://www.softwaretestinghelp.com/what-is-cryptocurrency/

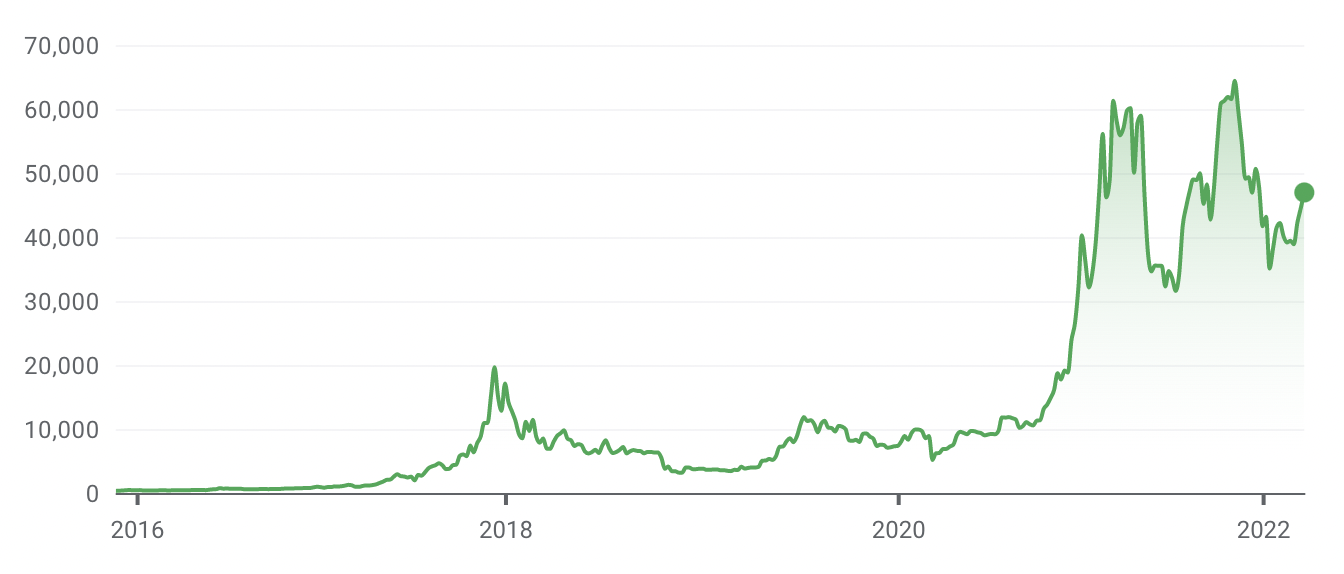

Bitcoin began the month of March 2022 with a price of approximately $42,335 and has now grown to about $46,994 as of March 28th. This 11% growth may seem substantial, but it is very mild compared to the past. In 2017 the price of Bitcoin rose from $974 to $20,000, boasting a 1,950% increase. Although, with massive increases also came massive decreases. One of the most recent crashes took place in May 2021. On April 14th, 2021, Bitcoin reached a record high close of $64,000. Only a month later the price sank to around $35,000 on May 22, 2021, showing an approximate -45% return. The worst drop of Bitcoin was on June 19, 2011, when the price opened the day at roughly $17.5 “flash crashed” -99%, leaving the closing price for the day sitting at just around a penny.

Bitcoin Price Chart

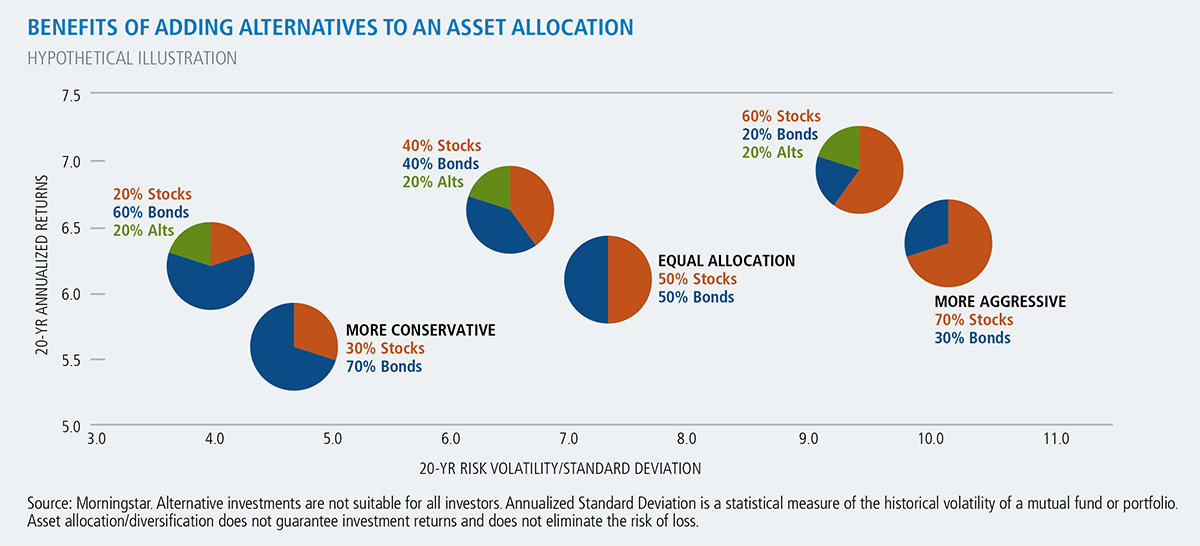

An investment this volatile, carries extraordinary risk and creates an environment where an individual could gain or lose large amounts of money. Risk-averse investors tend to favor fixed-income instruments as opposed to this volatility. The Family Business Fund (FBF) offers a promissory note without the volatility that we see in something like Bitcoin. Family Business Fund provides a high-yield, fixed-income investment option through offering notes with a 15% yearly return with a monthly distribution. Alternative fixed income products are not attached to any market volatility which in turn, helps flatten out the volatility curve in your portfolio. This also gives an investor the option to generate a steady source of income over time. The returns from this steady source could be used to help offset losses from unpredictable, more volatile investments such as Bitcoin, even possibly providing returns in excess of hedging unwanted volatility.

The Family Business Fund and Bitcoin both offer an alternative investment. Alternative investments, in general, usually show a weak correlation to the stock market, making both options great potential additions to diversify a portfolio. Diversification can be used to “spread” investments around so exposure to one specific asset is limited. This is helpful in reducing the volatility of a portfolio over a period of time. Ultimately, where FBF notes, and Bitcoin differ is volatility. There is a lot of uncertainty and unpredictability in Bitcoin and the historical swings in price exhibit that. Family Business Fund has a constant fixed rate of return of 15% yearly. Regular, dependable returns of 15% every year can provide investors with more certainty and confidence in their portfolio as a whole.