Per: https://www.nytimes.com/live/2022/04/12/business/cpi-inflation-report

Investing in equity markets requires the purchase and sales of stocks on an exchange. The New York Stock Exchange (NYSE) is the largest stock exchange in the U.S. By purchasing equities, investors obtain partial ownership of the issuing companies. A return on the purchase can be seen through capital appreciation or dividends paid on the stock. Equity markets typically offer higher returns but carry additional risk than fixed-

income markets. Equity has systematic risk that is also known as market risk and refers to the market volatility in different economic conditions. The other type of risk is unsystematic risk and refers to the risk that is dependent on the operations of individual companies. Systematic risk cannot be avoided but unsystematic risk cannot be predicted and can be offset through diversification (e.g., investing in securities from many different industries).

A fixed-income investment promises fixed amounts of cash flows at fixed dates and the repayment of principal at maturity. These are commonly referred to as debt instruments or the bond market. One type of fixed-income investment consists of securities issued by the federal government, corporate bonds, municipal bonds, and mortgage debt instruments. These investments receive a smaller return but are considered less risky and volatile than equity investments. A problem that arises with this type of investment is default risk, which is the chance that the borrower will not be able to make payments on the debt obligation to the lender. The other type of fixed income investment instruments are alternative investments like REITs, private credit, oil & gas and many more. These types of investments typically have a higher fixed rate of return.

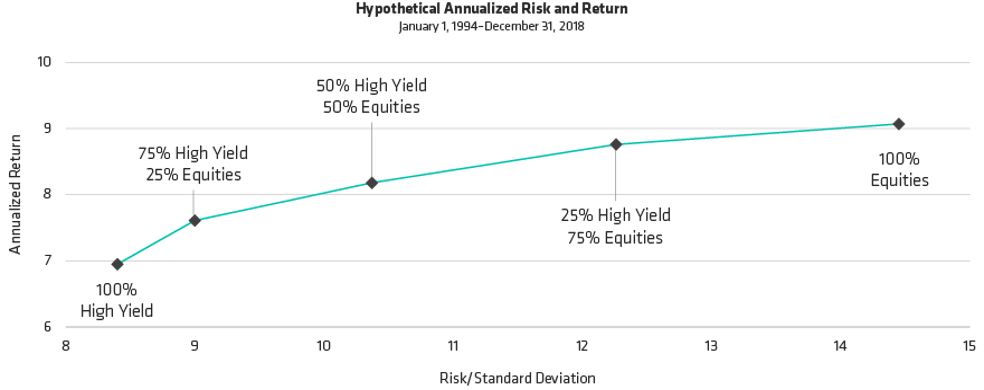

Both equity and fixed income products are great financial instruments to help investors achieve their goals. A combination of both asset classes can achieve a balanced risk and return combination for a portfolio. Equity and fixed income returns are uncorrelated with each other. This allows fixed-income investments to add predictability and safety to a portfolio. On the other side, equity investments have the potential for higher payoffs. An investor should focus on maintaining a balanced portfolio by allocating a combination of equity and fixed income products based on their risk tolerance.

To learn more about alternative investing or the Family Business Fund, please contact Douglas Muir at douglas@familybuisnessfund.com or (888) 884-6442.