Throughout 2022, many investor portfolios have shown a sea of red and have seen extraordinary volatility in the stock market. A good performance indicator of the stock market is the S&P 500, as it is an index containing 500 large public companies located in the United States. The S&P 500 is down around 19% from its record closing high of $4,796.56 on January 3rd, 2022. The index is awfully close to being considered heavily bearish if it breaks a 20% drop from its all-time high. This is the largest losing streak since the dot-com bubble and stems mainly from concerns over tightening monetary policy, the elasticity of the economy, and corporate profits while dealing with the heightened inflation.

https://www.edwardjones.com/us-en/market-news-insights/stock-market-news/stock-market-weekly-update

The recent volatility comes from the lower-than-expected earnings from major U.S. retailers. This shows that big companies are having trouble passing on rising costs to consumers. Stores like Walmart and Target have seen their profitability impacted by inflation and supply chain disruptions. This ultimately leads to companies taking a hit in their stock price. According to Yahoo Finance, “Walmart shares dropped 19.5% this week in the stock’s worst weekly performance on record.”

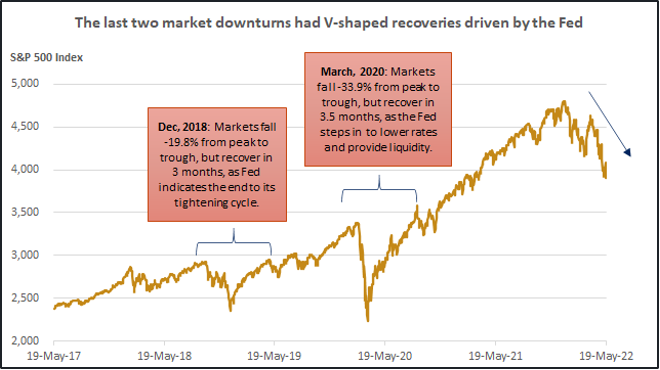

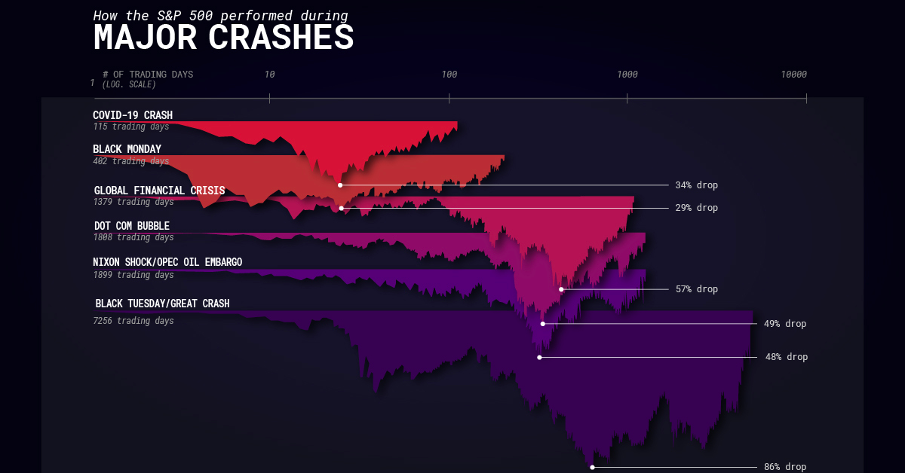

The S&P 500’s 2022 downfall is primarily a result of rising worries regarding increasing rates of inflation, ongoing supply issues, Federal Reserve rate increases, the war in Ukraine, and continually growing COVID-19 cases. With all these factors escalating, many economists are warning of a possible recession, and many investors are becoming more interested in taking money out of their risky assets. A recession is defined as two consecutive quarters of negative gross domestic product (GDP) growth. If the U.S. falls into a recession, the S&P 500 (according to history) should fall around 29% on average. Let’s compare this decrease to some of the recent major S&P 500 crashes.

During the dot-com bubble in 2000, the S&P 500 dropped around 49% and had a peak-to-peak recovery of 1808 trading days. The dot-com bubble included an increase of speculative investments in internet-based businesses. This led to a burst when many of these companies had business models that were proven to be unprofitable. The global financial crisis happened in 2008 and was caused by the U.S. housing bubble collapse, as well as an international banking crisis. The S&P 500 dropped 57% and took a peak-to-peak recovery of 1379 trading days. The most recent and fastest fall to recovery of 117 trading days was experienced during the COVID-19 crash. It fell 34% due to the virus ultimately shutting down the economy.

https://finance.yahoo.com/news/stock-market-news-live-updates-may-20-2022-111628024.html

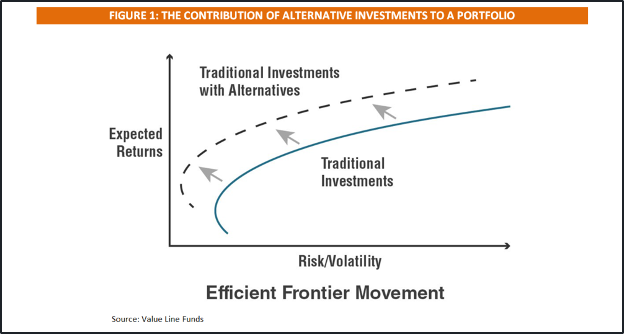

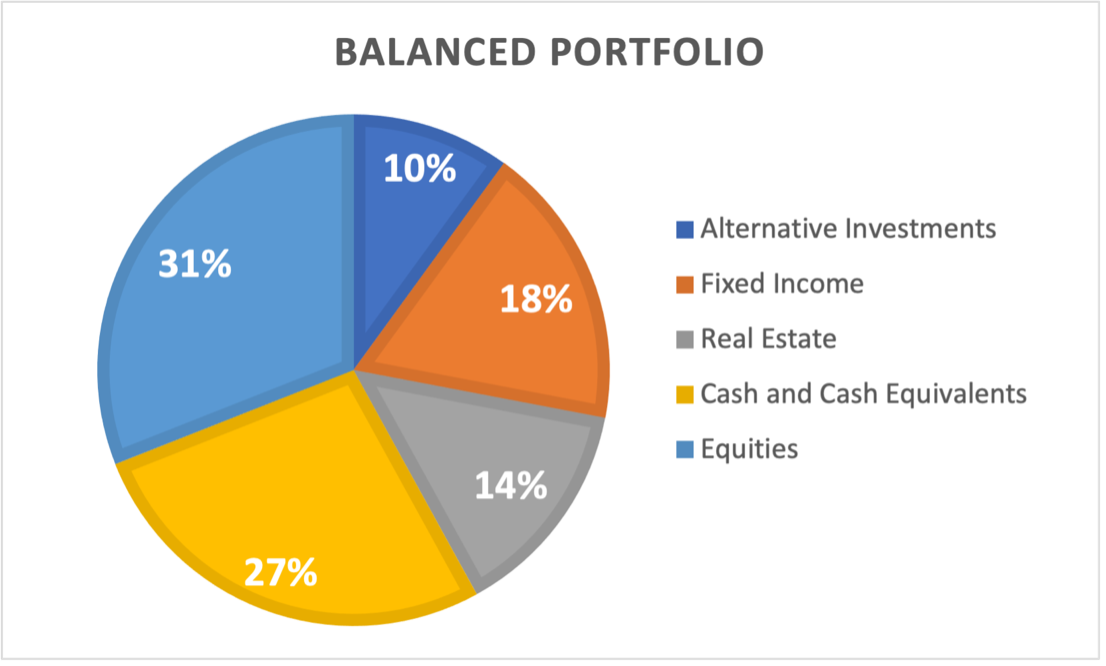

For investors that focus on the preservation of capital, a balanced portfolio can provide less risk. In times of extreme downturns, balanced portfolios can help mitigate losses from a big market crash. On the other hand, they perform more conservatively in bull markets. A balanced portfolio has diversified investments depending on the investor’s risk tolerance and end goals. Diversification works well because different asset classes react differently to the same economic event. For instance, if an investor had 100% of their portfolio in stocks, they would have seen major losses this past week. Though, if they had 60% in stocks and 40% in a well-performing fixed alternative investment option, the losses caused by the same market downturn would be lessened from the return on the alternative investment.

Alternative investments typically have a low correlation to traditional asset classes like stocks. This means that the price movement of one asset has little to no effect on the price movement of the other asset class. Adding these investments lowers the risk exposure and volatility of a portfolio while potentially increasing returns. With all of the recent stock market headlines being mainly negative, it is important to pick investments that are uncorrelated to stocks for protection against market pullbacks. Another benefit of alternatives is that they have a vast set of investment opportunities. This allows investors to pick the most attractive options outside of traditional asset classes depending on the macroeconomic events or the market cycle.