I am constantly asked, “when investing in a Private Placement Alternative Investment, which is better, Debt or Equity”? This is a great question, and I will answer this question in this article. I will be using my company, the Family Business Fund as an example since we allow our investors to chose which type of investing, they are comfortable with.

Equity vs. Debt

Equity Investing – Is a long-term play (ex. Buy 100,000 units @ $1.50; Sell at $10.00 5 years = $170,000/year). What do I mean by that? Equity investing is buying a piece of a company hoping that the stock / unit price will increase before selling it.

Debt Investing – is lending a company money (debt) and they pay you back a certain percentage rate per year. This percentage rate will rarely change and is a constant flow of cash. (ex. invest $100,000 @ 20%/year receive $20,000/year)

Private companies raise money by seeking out investors using a document known as a Private Placement Memorandum (PPM). A PPM is the document that outlines the investment strategies, risks, underlying asset to produce profits and much more. The Family Business Fund (FBF), for example, is a private company using a PPM to raise money. They offer debt and equity investing as explained above. Most private placement investments are not available to the public and are not as liquid (transferable) like stocks on the New York Stock Exchange. The Family Business Fund is an SEC Reg. D. 506 C private placement company that requires their investors to be accredited (definition). However, there are some Funds that will register as a Reg. A for non-accredited investors.

Companies who need to raise capital by using external financing options to fund expansion will use one of the two primary options as discussed above, 1) Equity 2) Debt. A company may also use a combination of the two to meet the business needs as does the Family Business Fund. Debt financing deals with a company borrowing money from their investors by using a promissory note to pay back. This note will include the terms such as length of time, amount of interest to be paid, and expiration date to return the borrowed money. The company can use any debt instruments such as bonds, bills, or notes. An alternative to debt is equity investing, which is raising capital from selling shares / units of the company. The number of shares an investor owns, is relative to purchasing ownership of the company. An important feature to the company of debt financing is the company does not lose any ownership whereas a benefit of equity financing is the company can keep their cash flow to expand, not pay back debt.

Equity Financing with Family Business Fund

Equity financing is the process of selling shares/units of the company to raise capital for the business. Investors prefer this option to have ownership of a fast-growing company like Family Business Fund. Owning shares of a private company is less liquid because there is not a public market to sell them on, like the New York Stock Exchange. A benefit of owning private shares in a non-public company is the ability to buy in at a low valuation and receive high returns upon exiting the company years down the road. To find the share price of a private company, is more difficult than finding the valuation of a public company. To find the valuation of a private company you will need information only provided by the company and that is not in the public domain. To continue using the Family Business Fund as an example, this is how their valuation was completed. It involved four methods that were subsequently averaged.

1. First Valuation – was EBITDA times the industry multiple and then discount the liabilities. EBITDA is earnings before interest plus taxes plus depreciation plus amortization. A multiple helps compare certain companies within an industry and the first industry we chose is Investment Management and Fund Operators. We used the month of April’s EBITDA to forecast this year.

$66,031(April’s EBITDA) * 12(Months) = $792,374(2021 EBITDA) * 20.14 (Industry Multiple) = $15,958,412.4(Enterprise Value) – $3,203,552.40(Total Liabilities) = $12,754,860 (Final Valuation)

2. Second Valuation – was revenue times industry multiple and then discount liabilities. Revenue is the total amount of income generated. We used the month of April to forecast the yearly revenue and chose the industry Personal Credit Institution for this analysis.

$129,295(April Revenue) * 12(Months) = $1,551,540(2021 Revenue) * 6.06(Industry Multiple) = $9,402,332.4(Enterprise Value) – $3,203,552.40(Total Liabilities) = $6,198,780 (Final valuation)

3. Third Valuation – used is EBIT times industry multiple and then discount liabilities. EBIT is earnings before interest plus taxes. The industry we used is a Personal Credit Institution. We used the month of April to forecast the yearly amounts.

$66,031(Aprils EBIT) * 12(Months) = $792,374(2021 EBIT) * 14.29(Industry Multiple) = $11,323,024.5(Enterprise Value) – $3,203,552.40(Total Liabilities) = $8,119,472(Final valuation)

4. Fourth Valuation – method performed was the assessment of the 50/50 model. This means that the company is financed with 50% debt and 50% equity. Cost of debt is 20% and the cost of equity is 100%. The long-term growth rate is 3%. Through the model this has a FBFM valuation of $34,262,216.

The average of all the methods is ($34,262,216+$8,119,472+$6,198,780+$12,754,860)/4= $15,333,832.

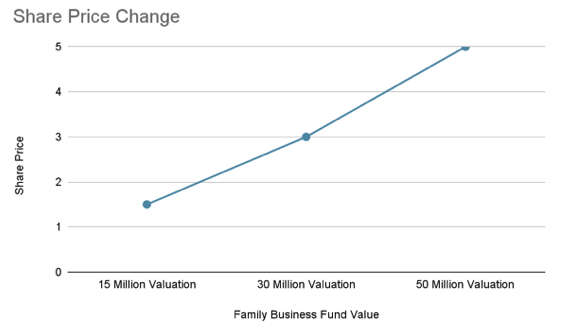

In conclusion: the analysis of the average of three comparable and the 50/50 model recommends using a valuation of 15 million. The Family Business Fund has 10 million shares making the price of the shares $1.5 (15 million/10 million). FBF fund has a supply of 10 million dollars that will rapidly increase to achieve 50 million dollars. The company’s valuation will follow in-step. A 30-million-dollar valuation will have a stock price of $3 (30 million/10 million). A 50-million-dollar valuation will have a stock price of $5 (50 million/ 10 million). If an investor would have invested $100,000 at a 15-million-dollar valuation, they would own 66,666 shares ($100,000/$1.5 share price). If the valuation raised to 50 million the approximate holdings would now be worth $333,330 ($5 share price*66,666 shares). This is a $233,330 increase from the original investment or a 233% increase.

Debt Financing with Family Business Fund

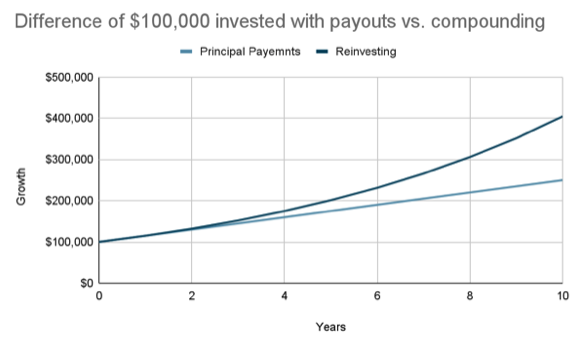

Debt financing entails borrowing money and paying it back with interest. Debt financing at the Family Business Fund will give out quarterly payments which could see a return faster than buying equity. Family Business Fund offers 10-year notes with yearly 15% interest on those notes. The minimum note that is offered is $20,000 but an investor can purchase multiple. An investor also has the option to redeem the notes after 18 months or reinvest the interest payments. An investor who buys 5 notes for $100,000 will have a yearly interest payment of $15,000. If the investor decides to reinvest the interest payments, then it will compound. Compounding interest accelerates your earnings by giving interest on top of interest. For example, if an investor reinvested their $15,000 the second year the 15% would be paid on $115,000 and have a return of $17,250 instead of the standard $15,000.

Redemption Options

A big question for investors is how to liquidate their debt or equity. Family Business Fund debt investments can be redeemed any time after 18 months. This represents getting the principal back and interest payments throughout. Alternatively, an investor could wait 3, 5 or 10 years until the note matures on most Alternative investments. For equity shares of the company there are several different possibilities. Some private placement companies offer a buyback program where the companies repurchase the shares an investor bought. Another way is a different private equity company purchases the business at a higher valuation than what the stock / units were purchased at. The private equity company will buy out all the previous shareholders to own most or all of the company. An additional option is selling shares if the company goes public and gets listed on a stock exchange. This will allow the previously private shares to be open to the public. The last way to sell shares of a private company is to sell them on a private market exchange. NASDAQ has a private market to sell certain shares.

Conclusion

A company has two main ways to raise capital. Family Business Fund utilizes both debt and equity to raise money and expand. This capital can be used to add more assets to the fund to increase merchant cash advances and increase return on investment (ROI). Another option is to use the funds to reinvest in the company’s expansion. Whether the investor wants to go through equity or debt should be based on their long-term goals. If the investor wants to have a steady income of 15%, they should invest in the notes offered by Family Business Fund. On the other hand, if the investor chooses to invest in shares of the company, they can achieve exponential growth. The Family Business Fund offers two options to invest with excellent returns.

About Family Business Fund

The Family Business Fund was founded in 2018 to help ensure that small businesses have access to the resources needed to thrive. Founded by small business owners for small business owners, we provide alternative funding to small and mid-sized businesses in need. For more information, contact Douglas Muir at douglas@familybusinessfund.com or call (888) 884-6442 ext. 3.