This past Friday marked the worst Black Friday stock market performance since 1950. All three major indexes lost around 2% in a single day. The indexes remain negatively impacted. I’ve had friends call and tell me that they lost all their gains in one day. Many experts are blaming this huge decline on the latest Covid variant. The new variant was discovered in South Africa and the U.S. has already restricted travel from eight African countries. Investors are worried that the rapid spread of this new Covid strain could crash the global economy.

Typically, Black Friday is a strong day for retail and entertainment stocks. However, since stock market movements are highly influenced by current news (specifically, the new COVID variant), the market took a dive, wiping out many investor gains. Generally, negative news will cause people to sell stocks, which drives the stock price down, whereas positive news (such as good earnings report) can increase a stock’s price. It is incredibly difficult to forecast these types of trends, especially when news arrives in a random fashion.

Accordingly, smart investors are always looking for ways to lower risk and maintain a balanced portfolio. An investor can achieve this from investments that are diversified across different asset classes in varying sectors. This is the best way to hedge risk and “come out on top” on a day like this past Black Friday.

Novice investors often do not realize that there are investments outside of traditional assets. Traditional assets like stocks and bonds are highly correlated to market events. One bad tweet can mean losses across your whole portfolio!

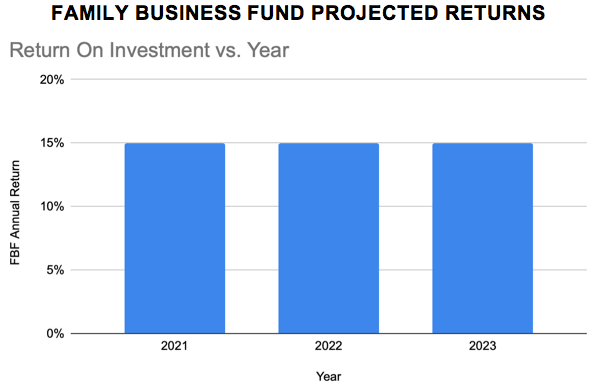

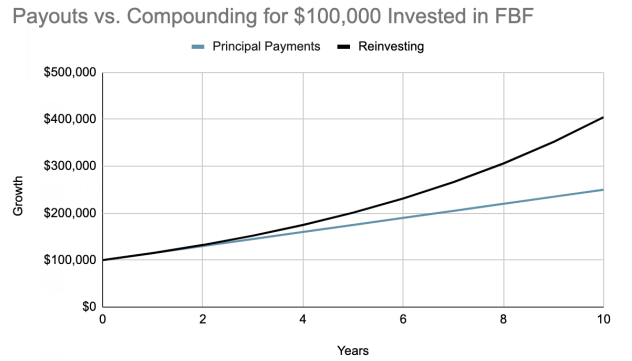

This is where non-correlated assets such as alternative investments can help diversify a portfolio. Many alternative investments are not connected to the stock market’s ups and downs and not subject to the market’s fluctuations. Accredited investors can invest in safe high-yield fixed-income funds like the Family Business Fund with a yearly rate of return of 15%. The high-yield offered by this fund can help flatten the volatility of a portfolio. No matter how the market moves, an investment in the Family Business Fund pays an annualized 15% return.

The Family Business Fund’s underlying assets are Merchant Cash Advances (MCAs). MCAs were originally started by large private equity firms. The term is now commonly used to describe a variety of small business financing options characterized by short payment terms (generally under 12 months) and small regular payments (typically paid each business day or weekly) as opposed to the larger monthly payments and longer payment terms associated with traditional loans.

Most investors I talk with are unaware of the world of alternative investment vehicles that exist outside of the stock market. Alternative investments were often only available to the ultra-wealthy. The Family Business Fund offers this unique opportunity for accredited investors and could protect them from downside and create a consistent return on investment.