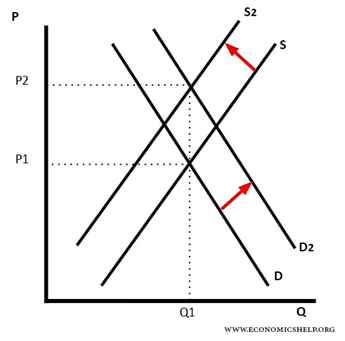

Inflation is characterized by the increasing prices of goods and services in an economy. The inflation rate represents the rate at which the value of an investment is eroded and the loss of purchasing power over time. The leading cause of the current inflation increase can be attributed to COVID-19 and its effect on economical supply and demand. The demand was raised with the rapid increase of the money supply from stimulus checks and government bond-purchasing activity. This is known as “too many dollars chasing too few goods”. The supply was decreased with supply chain disruptions that led to less productive output of goods in the economy.

The above diagram shows an increase in demand (D to D2) and a fall in supply (S to S2). The result is an increase in price.

Per: https://www.economicshelp.org/blog/1811/markets/diagrams-for-supply-and-demand/

The current annual inflation rate for the United States is 7%. Investors should buy investments with returns that are at least equal to or greater than the inflation rate since inflation eats away at investment returns. The real rate of return is the annual percentage earned on an investment after being adjusted for inflation. The real rate of return accurately indicates the purchasing power of money. For example, if a $100 investment in Coca-Cola increased $10 in 2021, the nominal rate of return was 10%. Since the inflation rate was 7%, the real return is 3% (10%-7%). The investor truly made $3 or 3% from the Coca-Cola investment.

.png)

Per: https://sbhic.com/wealth-management/impact-inflation-investments-savings/

How Inflation Impacts Investing in Different Asset Classes:

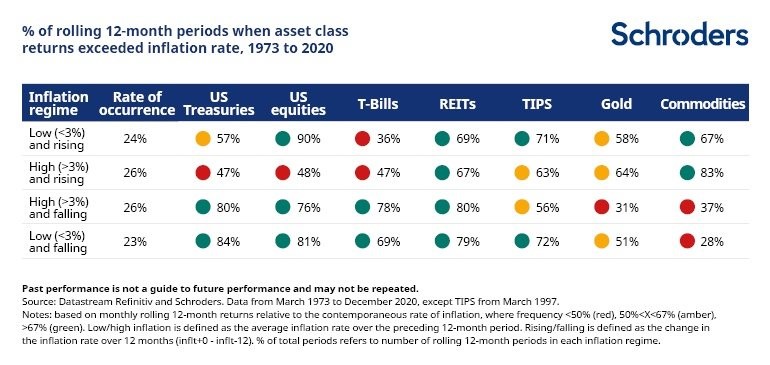

Commodities:

A commodity is a raw material or agricultural product that can be bought and sold. As demand increases, the price of goods and services rises as well as the commodities used to produce those goods and services. This makes commodities a strong hedge against inflation. Their prices define the underlying inflation since the consumer price index (CPI) is measured as a weighted index of the costs of different goods and services.

Gold:

Like commodities, the same inflation relationship holds for gold since gold is a precious metal (which is a commodity). The price of gold increases with the value of inflation because it is dollar-denominated. A stronger U.S. dollar usually keeps the price of gold lower and controlled. A weaker U.S. dollar is likely to raise the price of gold since more gold can be purchased with a weaker dollar. Because gold’s supply is limited and tangible, it combats inflation.

Real Estate:

There is a high correlation between inflation and real estate assets. As inflation rises, property values rise, and so does the amount charged for rent to offset increasing input and consumption costs. Real Estate Investment Trusts (REITs) invest in a pool of real estate assets and are an easy way to gain exposure to this asset class without directly investing in property.

Fixed Income:

Fixed income refers to investments that pay investors fixed interest or dividend payments until their maturity date. Some examples of this kind of investment are government or corporate bonds, commercial deposits, or notes from The Family Business Fund. Inflation impacts fixed-income investments due to the indirect relationship with interest rates. Since interest rates on debt instruments are fixed over their term, their expected returns cannot increase to beat inflation. Prices of these instruments fall as investors sell the existing low-yielding products and buy into higher-yielding ones. Inflation-Protected Securities are a type of bond class that adjusts yields to inflation and are a popular choice during times of high inflation rates.

Equities:

The relationship between inflation and equity prices is not straightforward and cannot be applied to all equities. Though, in the short run, inflation has a mostly inverse correlation with equity prices, meaning that as inflation rises, stock prices fall. This could be caused by declining revenues and profits that pull down share prices. Truly, equities can act as a hedge to inflation in the long run. Once a company adjusts for the inflationary pressures and prices, its revenues and profits will appear to return to normal. This is due to the higher input costs that are passed on to consumers after adjusting the companies’ margins.

Family Business Fund (FBF):

Family Business Fund offers a high-yield, fixed income investment opportunity that pays 15% annually. This high-interest rate helps to fight off inflation that could take away from an investors’ returns. A 2021 investor in Family Business Fund would have a nominal return of 15% but adjusting to inflation the investor would have a real return of 8% for the year. FBF allows investors to take advantage of fixed payments that bring in stable cash flows without the volatility that other investments have.