Dear Loyal Investors,

I hope this email finds you well. May was an exciting month for FBF, highlighted by the official launch of our partnership with A3 Financial Investments (A3) (NASDAQ:AAACX). We were able to fund several new deals as part of that partnership and are now discussing some very unique and interesting joint venture opportunities with the A3 leadership team. Doug also visited Charlottesville for a week in early May and helped us open a new, satellite office in the CODE building (https://codebuilding.com/), along with securing several new investors for FBF. We expect Doug to be in the Charlottesville office about once every 4-6 weeks.

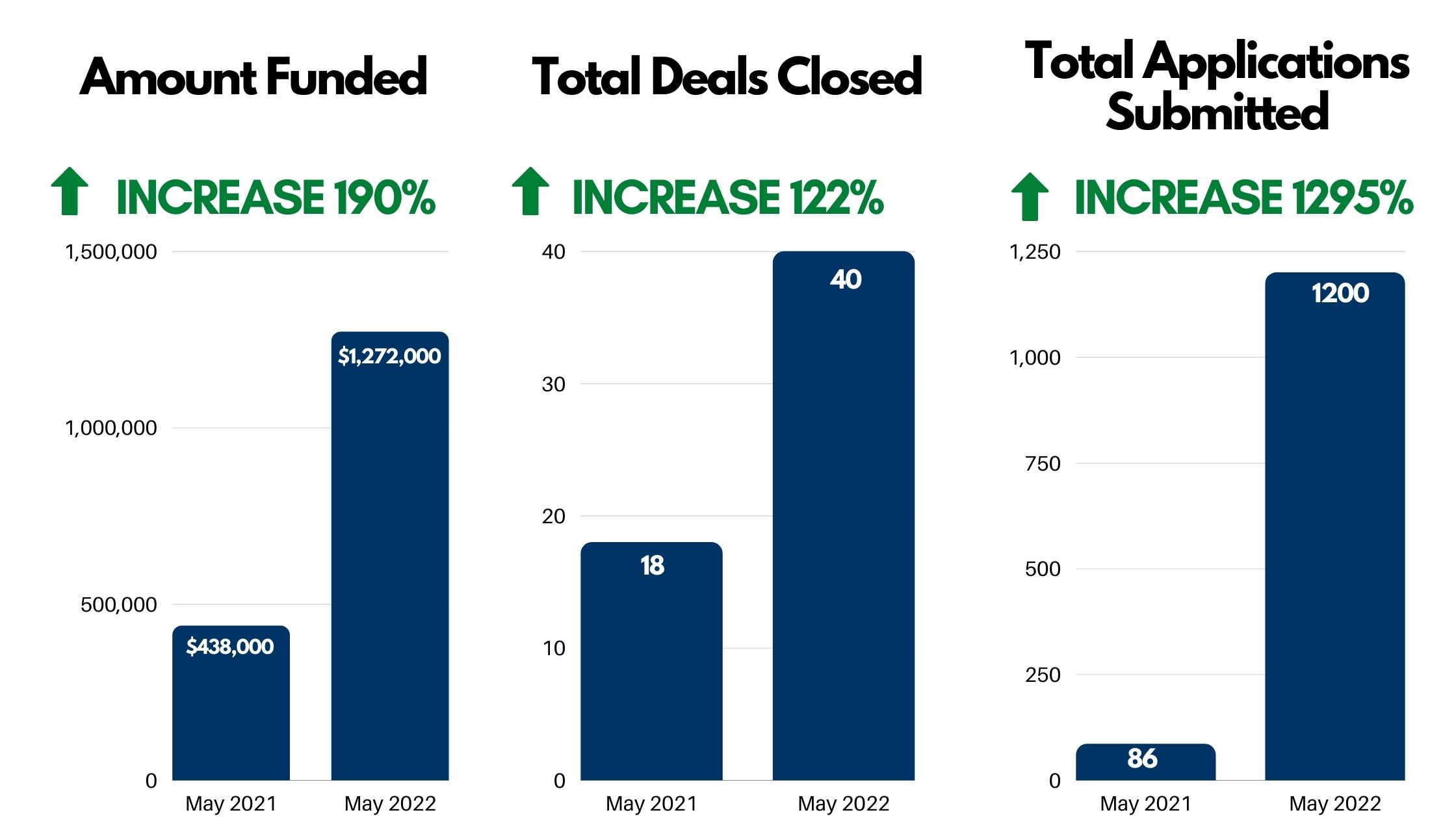

As you can see below, our numbers stayed on the same trajectory as in the first few months of 2022.

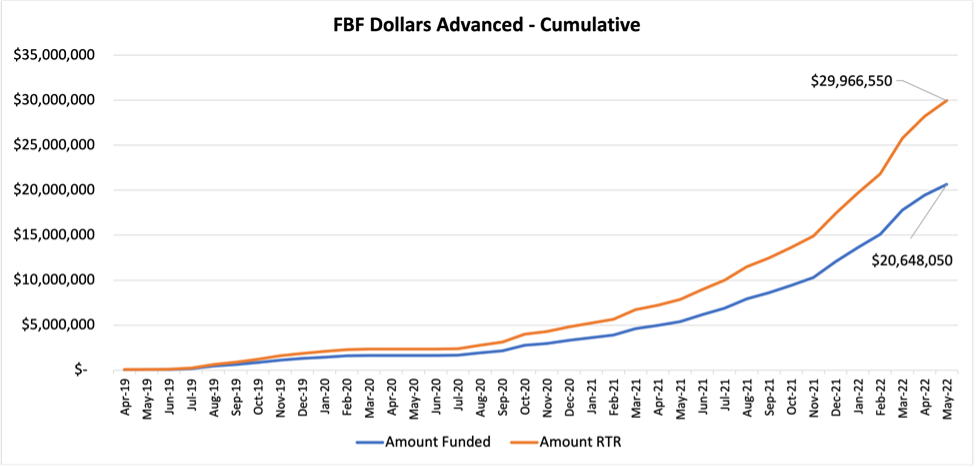

We did have a slight increase in our default rate (up to 5.64%) but we remain vigilant with our collections process and proactive with our reconciliation efforts. For example, our underwriting team contacted most of our MCA merchants in trucking in mid-May to get out in front of the rise in the price of diesel and the disruption to the supply chains. The gratitude expressed by our trucking merchants was absolutely amazing and helps us continue to set the gold standard for the industry. The only bit of disappointing news came from Wells Fargo when they declined us as a client, so we are now working closer with Columbia Bank to help them enhance their offerings in order to meet our specific needs. We go into the last month of Q2 with high hopes and momentum both on the investor/strategic partnership front and on the operational side. We are revising our pitch deck for our institutional investor road show, and I wanted you to preview one of the new slides that shows the growth of FBF from inception. See how far we have come Page 2 of 3 in cumulative dollars advanced since 2019. They say a picture is worth a thousand words and every time we look at the graph below, we continue to be amazed and humbled.

We couldn’t do what we do without you, so thank you again for your faith and trust in FBF and the team that runs it.

Updates:

.png) |

Traditional Investing Is Dead Episodes Are Now Available Wherever You Get Your Podcasts!

|

Articles:

.png) |

.png) |

| Small Businesses Cannot Rely on Banks

June 1, 2022 |

How Low Will It Go?

May 24, 2022 |

|

|

With appreciation,

Douglas Muir, CEO