Between inflation soaring to 7.9% in February 2022 and a stumbling stock market, investors lack confidence regarding where they should invest their money. The stock market has been very volatile in the first part of 2022 due to a plethora of uncertainties. The investors seeking a more reliable source of income frequently look at treasury bonds. A significant problem with these is that most yields on the bonds are minuscule and often deteriorated by inflation. With high inflation rates, an individual holding cash will see a decrease in the purchasing power of their money. That $100 gift will cost $107.9 at the current rate. No matter what investment is pursued, the return needs to at least match or be higher than the current rate of inflation to maintain purchasing power. Considering this, two possible investment choices include Series I savings bonds and high-yield fixed-income investments.

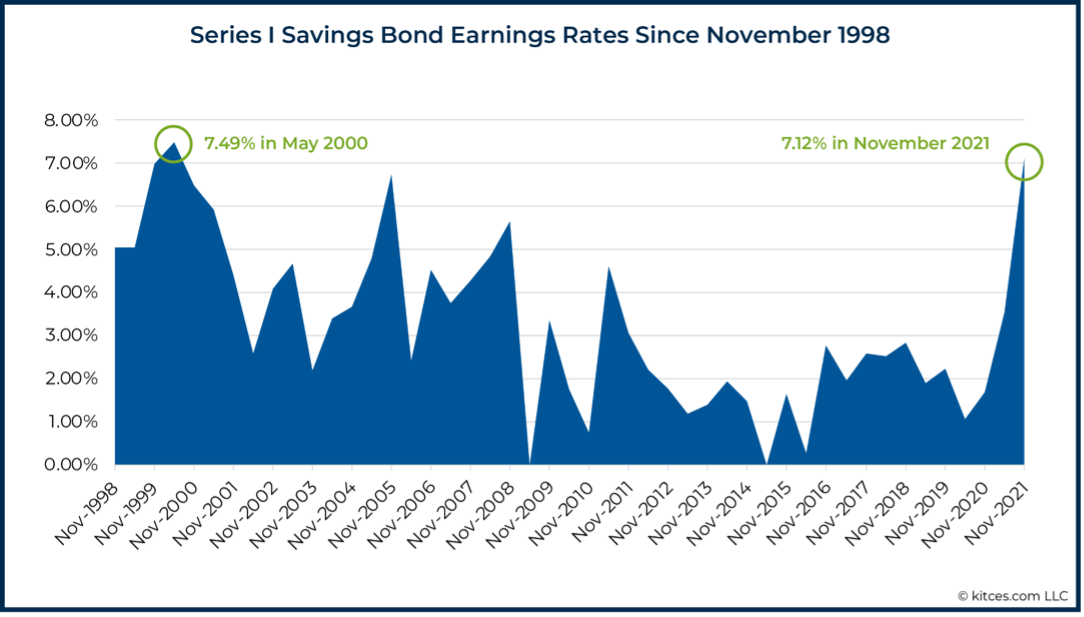

A Series I bond is a U.S. Government savings bond that earns both a fixed interest rate and variable inflation rate. The fixed-rate component is announced every six months on the first business day of May or November. This fixed rate is then applied to all Series I bonds that are issued during the next six months. This rate does not change throughout the life of the bond and is compounded semiannually. On the other hand, the inflation rate aspect of these bonds is also announced twice a year in May and November but is determined by changes in the Consumer Price Index (CPI). The CPI measures inflation by tracking the average difference in prices paid by consumers for a basket of goods and services over time. This change in inflation is applied to the bonds every six months. The total rate which represents the combination of these two, called the composite rate, has been placed at 7.12% for November 2021 to April 2022. Right now, the bonds have a current fixed interest rate of 0%. The entire composite rate of 7.12% is being drawn from the variable inflation rate to compensate for the extraordinary inflation that is being experienced.

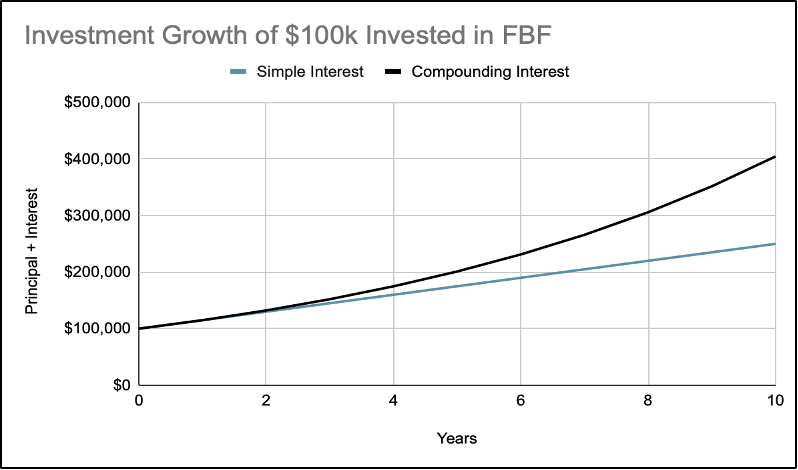

The Family Business Fund (FBF) offers a high-yield fixed income alternative investment option. Investment in FBF is through a promissory note with an initial face value of $20,000. The note matures in 60 months, but FBF allows their investors to receive their money sooner if they so wish. Money can be taken out any time after Family Business Fund’s lockup period of 18 months. The notes have an above-average 15% annualized return that is paid out to investors monthly. Also, FBF offers an option to reinvest the returns so that the capital can compound, leading to exponential growth.

The Series I bond and FBF promissory notes could both be great investment options during this time of uncertainty. The Series I bonds that track inflation allow investors to keep most of their purchasing power. On the other hand, Family Business Fund’s investment interest rate is high enough that it could possibly beat inflation and provide a return. Another big difference between these two options is that FBF offers a fixed rate at 15%, while the Series I bond rates can move up or down with inflation. The Federal Reserve is expected to start increasing interest rates this month (March 2022) to decrease inflation. The next adjustment period for Series I bonds starts at the beginning of May 2022. If the Federal Reserve is successful, the interest rates on this type of bond are likely to fall. It is also important to note who the issuer is for both of these investment options. Since the government issues the Series I bonds, they are considered “risk-free” assets. FBF notes are unsecured obligations of FBF which fundamentally means that if FBF were to fail as a company, then the investment might be lost; though, FBF constantly pursues ways to perfect its business model and reduce investor risk.