Dear Loyal Investors,

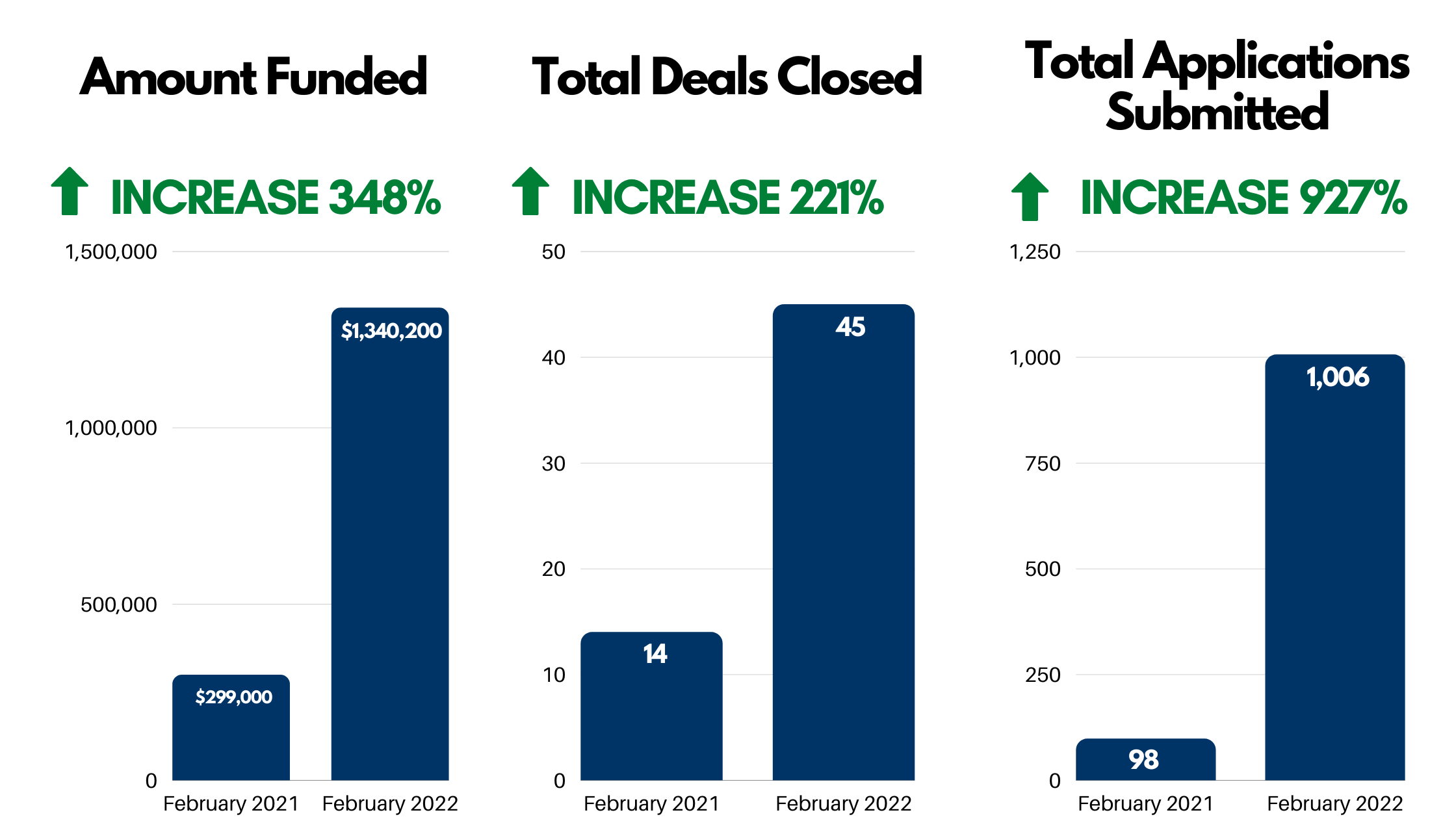

I hope this email finds you and your family in good health. February has come and gone, and we had another incredible month at Family Business Fund (FBF). I know that I may sound like a broken record; but, as you can see from the charts below, we blew away every goal, projection, and expectation again. While growth is a good thing, too much growth too fast can be detrimental. For that reason, we limited the amount of advances in February to $700,000 per week, which gave us the breathing room needed to prepare for an internal audit, implement our new software platform, and train our new employees at a more manageable rate.

Our new full-time staff has hit the ground running. In particular, Rob C. Masri, Esq., who serves as in-house counsel and handles compliance and investor relations, has proven to be an invaluable part of the firm and we are lucky to have him.

Rob and I secured an investment commitment from A3 Financial, a mutual fund based in Denver Colorado. As you might imagine, receiving an investment from an SEC-registered mutual fund like A3 Financial adds a lot of creditability to FBF. You can learn more about A3 here: https://www.a3.financial/.

In addition to securing the A3 investment, February was an important month for FBF:

- We purposely did not make any advances during the first week of February in order to prepare for our internal audit (business as usual resumed on Monday, February 7)

- We spent considerable time communicating with our broker network to maintain their trust and solidify our partnership during the first week of February.

- We focused our fundraising efforts away from individual accredited investors to institutional investors who could invest $5M or more. We have two prospects at this point.

- We hired another underwriter, administrative support staff, and marketing assistant.

- We trained all new hires and underwriters on the proprietary software and technology platform created by our CTO, Valeria Bisenti.

- We reviewed and refreshed our policies and procedures for streamlining all MCA processes from beginning to end.

- We reviewed the collection procedures with our two law firms to ensure greater protection in any default scenarios.

- We engaged in additional stress tests and monitoring of the entire FBF portfolio to further de-risk our financial exposure.

- We began preparing FBF for its first private, third- party audit by an SEC registered public accounting firm.

Our default rate remains consistent at 4.3%. Again, to put this number into perspective, the national average default rate for MCA direct lenders like FBF is between 5%–15%, so we are doing very well. The number of files and the amount of funds advanced to clients has significantly increased month over month and year over year, so we will continue to monitor our default rate very closely.

FBF Outlook for March

The Family Business Fund’s success is due to you, the original investors who took a risk on me personally and on the company. I believe together we have created a company that serves the backbone of America, small businesses, and offers a high-yield, fixed income to our investors at the same time.

March is normally a big month for advances. We will be increasing our advances to $800,000 per week, which is an extremely comfortable rate for us. We will continue to pursue institutional investors (like A3 Financial) and will be attending two industry conferences while at the same time maintaining access to FBF for individual accredited investors who made us who we are today.

Again, thank you all for your faith and trust in FBF and the team that runs it.

With appreciation,

Douglas Muir, CEO